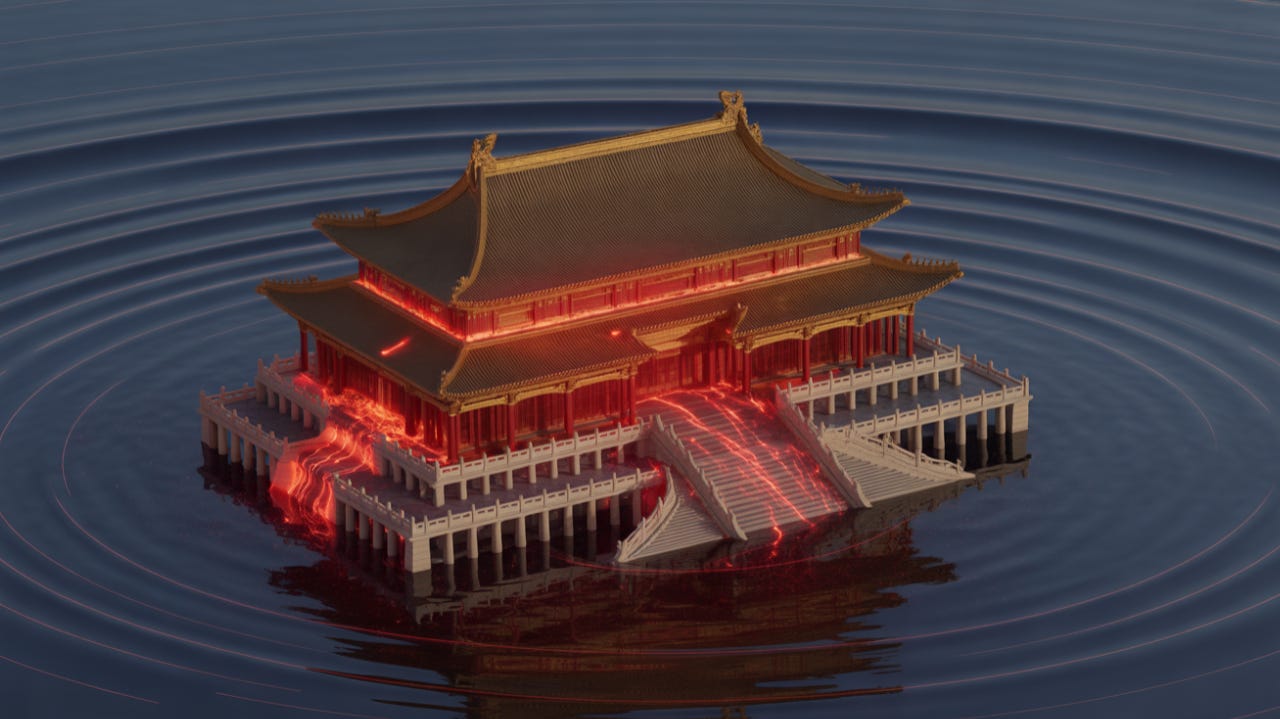

The 7 Unthinkables: China’s Black Swan Scenarios for 2026

How a tightly controlled system creates the conditions for shocks it cannot see coming

China enters 2026 with a governance model built to manage pressure by absorbing uncertainty and narrowing information flows. Yet the same tools that stabilize the surface create vulnerabilities underneath it. A system that prizes control creates blind spots. A system that performs confidence limits its ability to adjust. A system that relies on hierarchy weakens its capacity to detect early warnings.

Black swans emerge when a system cannot see the risks it generates. This dispatch examines the scenarios Beijing is least prepared to handle. They are not predictions. They are structural possibilities created by China’s own incentive environment.

Each scenario follows the same pattern. A trigger that appears manageable. A rapid chain of internal reactions shaped by information control. A moment when the system’s risk-transfer mechanisms fail. And a set of consequences that reshape the strategic landscape far beyond Beijing’s intention.

Here are seven black swan scenarios that could define China’s 2026.

1. A Sudden Fracture Inside the Rocket Force

China’s Rocket Force sits at the center of Beijing’s deterrence logic and its long-range strike capability. It also carries deep internal pressure. Years of purges, loyalty testing, and forced restructuring reduced space for officer initiative and created an atmosphere of bureaucratic fear.

Trigger

A mid-ranking officer exposes corruption inside a missile brigade or leaks internal readiness failures during an inspection cycle.

Why It Breaks the System

The Rocket Force relies on political discipline more than operational trust. A single crack prompts sweeping investigations that paralyze decision-making and cascade across multiple commands.

What It Means for 2026

Reduced readiness, delayed exercises, and a sudden shift in Beijing’s external posture as it compensates through cyber or cognitive pressure. The world sees a military that looks powerful but behaves defensively.

2. A Governance Failure in a Major Province

Provincial governments carry the weight of implementation. They manage debt, employment, infrastructure, and social stability. They also bear the consequences of political campaigns that limit local autonomy.

Trigger

A major province—Henan, Guangdong, or Sichuan—faces a debt restructuring that forces salary delays, stalled public projects, or supply-chain gridlock.

Why It Breaks the System

The central government cannot acknowledge local weakness without exposing the limits of its own model. Information flow tightens. External signals disappear. The province improvises under pressure.

What It Means for 2026

Beijing steps in late with a centralized rescue package that stabilizes the surface but erodes elite trust internally. Investor confidence weakens and provincial leaders shift into survival mode.

3. A Loss of Control Over Taiwan’s Information Environment

Cognitive pressure has become Beijing’s tool of choice. Yet the more China leans on this approach, the more fragile it becomes. Narrative dominance requires credibility the CCP no longer holds among key Taiwanese demographics.

Trigger

A coordinated disinformation campaign backfires. Youth voters or civil society groups expose the operation in real time.

Why It Breaks the System

Beijing’s narrative strategy depends on shaping inevitability. Once Taiwanese institutions publicly demonstrate resilience, the psychological effect reverses.

What It Means for 2026

China escalates its messaging while losing influence. Taiwan’s confidence rises. Japan and the United States accelerate coordination. Beijing’s reliance on cognitive pressure becomes a liability.

4. A Critical Breach in Semiconductor Supply Chains

China’s leadership treats advanced semiconductor access as the defining variable of national power. Beijing spent 2025 trying to route around US export controls while expanding domestic alternatives. The semiconductor chokepoint remains China’s most vulnerable dependency.

Trigger

A new US restriction cuts off China’s access to critical semiconductor manufacturing equipment, or a key Chinese supplier to global tech companies faces sudden sanctions.

Why It Breaks the System

China’s tech sector depends on global supply chains Beijing cannot fully control. A semiconductor disruption forces immediate choices between economic damage and aggressive retaliation, both of which expose strategic limitations.

What It Means for 2026

Accelerated economic nationalism. Expanded cyber operations targeting semiconductor companies. Increased pressure on Taiwan as Beijing seeks alternative supply routes. The line between commercial and national security ecosystems blurs across the Indo-Pacific.

5. A Major Corruption Scandal at the Central Level

Anti-corruption is the backbone of Xi’s authority structure. It enforces discipline, keeps elites compliant, and signals ideological purity.

Trigger

A scandal involving a senior figure in the State Council or the Central Committee leaks through unofficial channels.

Why It Breaks the System

Central corruption undermines the moral logic of Xi’s governance method. The system relies on fear, but also on the belief that discipline flows downward, not upward.

What It Means for 2026

A rapid campaign of purges across ministries. Policy paralysis while Beijing prioritizes political cleansing over economic management. Heightened risk tolerance in foreign policy as the system redirects attention outward.

6. A Governance Crisis in a Key Belt and Road State

China now relies on governance exports as a form of strategic influence. It embeds advisors, digital surveillance tools, administrative templates, and training programs across the Global South.

Trigger

A political transition or economic collapse in a partner state reveals China’s advisors played a direct role in unpopular governance decisions.

Why It Breaks the System

Beijing depends on the narrative that its governance model is stable, efficient, and replicable. A partner-state backlash challenges this claim and threatens China’s influence network.

What It Means for 2026

China faces a choice between doubling down with support packages or stepping away and risking reputational loss. Either path exposes limits in Beijing’s governance export strategy.

7. A Collapse in Elite Confidence Among Provincial Leadership

China’s political system rests on provincial party secretaries and governors believing in Xi’s method. These officials implement central directives, manage local crises, and maintain the facade of system effectiveness. Their confidence is cultivated through career advancement and ideological reinforcement, but it can erode when performance demands become impossible to meet.

Trigger

A combination of stalled economic performance, impossible growth targets, and internal purges creates a tipping point where provincial leaders begin quiet resistance to central directives.

Why It Breaks the System

Provincial elite confidence is the core stability metric. When it weakens, the system compensates with tighter control and more intrusive oversight, which accelerates the confidence erosion cycle.

What It Means for 2026

Rising internal surveillance. Faster turnover in provincial leadership. Increased pressure on military and security organs. A system that still functions but does so under self-imposed strain.

The Thread That Connects the Unthinkables

Each scenario begins with a manageable trigger. The escalation happens because China’s political system reduces its ability to see risks early, adjust quickly, or communicate clearly across institutions. Black swans in China emerge through structure, not chaos.

Information control slows detection. Hierarchy slows correction. Performance substitutes for adaptation.

This combination creates the structural conditions for strategic surprise.

The scenarios here offer a different value. They are not forecasts. They are diagnostic tools. Each scenario reveals where the system is most rigid, where governance transfers the most risk, and where Beijing’s incentives interact with global pressures.

The job for analysts in 2026 is to map how these vulnerabilities evolve under constraint. When a system limits its ability to see itself clearly, strategic shocks become more likely—not because the triggers are dramatic, but because they were visible all along.

Coming Friday:

In place of China This Week, the 2026 China Risk Framework releases for subscribers. It integrates all five dispatches into a single framework you can carry into the year ahead: cognitive patterns, structural fractures, analytic recalibration, predictive gambits, and the black swan possibilities that frame China’s strategic horizon.